Small Business Pulse Survey Completes Phase 7

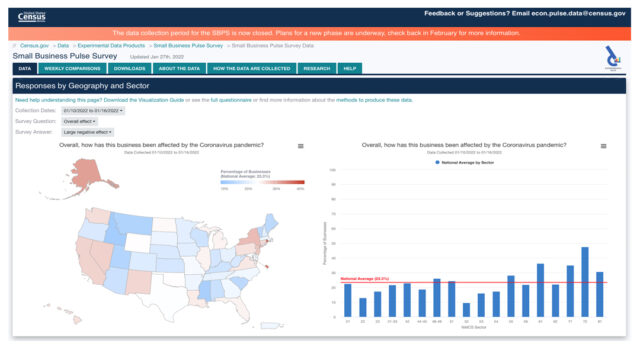

The U.S. Census Bureau has released the latest data collected through its Small Business Pulse Survey (SBPS), a multi-phasal effort which measures how the COVID-19 pandemic has impacted small businesses across the country. The most recent phase of this study concluded on January 16, 2022.

Beginning in April 2020, SBPS measures the impact of the COVID-19 pandemic across a number of variables, including operating revenues and finances, employee retention and scheduling, changes in operations since March 2020, and measures implemented to slow or prevent the spread of COVID-19 among employees, such as vaccination and testing requirements. Past surveys have asked about the implementation of curbside services, remote work, and loans and other assistance, among others. Impact is measured through self-reported metrics; the Phase 7 questionnaire can be found at https://portal.census.gov/pulse/data/downloads/small-business-pulse-survey-questionnaire_11_15_2021.pdf.

The Census Bureau has made the data collected across all seven phases of the study available on its website at https://portal.census.gov/pulse/data/, allowing for comparisons of responses over time. As of January 16, an average of 23.3 percent of businesses reported a large negative effect on business due to the COVID-19 pandemic, a marked decrease from the original average of 51.4 percent reported the first week of the study (covering April 26 to May 2, 2020). SBPS has further tracked difficulties and delays with suppliers both domestic and foreign since August 2020, shining a light on current trends for businesses and potential pain points in the coming months.

Phase 8 of the survey is tentatively planned to begin in February 2022. Further information on the SBPS may be found at https://www.census.gov/data/experimental-data-products/small-business-pulse-survey.html.

Work With Us, Work for Us

Econometrica specializes in research and management across numerous industries in both the public and private sectors. We are always looking to hire the best and brightest in data science, health, grants management, energy, homeland security, housing and community development, capital markets and finance, and transportation. We work as the lead service provider, and also as a capable outsource partner to other consultancies. To work with us on your next project, visit us online and email a member of our executive staff in your preferred specialty. To explore the benefits of working for us, visit our careers page.